What Does Idea Leap Help Support?

Community Impact

Innovative Solutions

Business Growth

Strengthened Local Economy

Community Impact

Innovative Solutions

Business Growth

Strengthened Local Economy

Idea Leap Loans

Flexible Financing for Emerging Businesses

Since 2016, the Idea Leap Loan program has addressed the funding gap for startup and early-stage businesses, providing over $6 million to more than 200 unique businesses.

- Loans from $2,500 to $75,000

- Expedited approvals

- Flexible underwriting

- Referral-based access

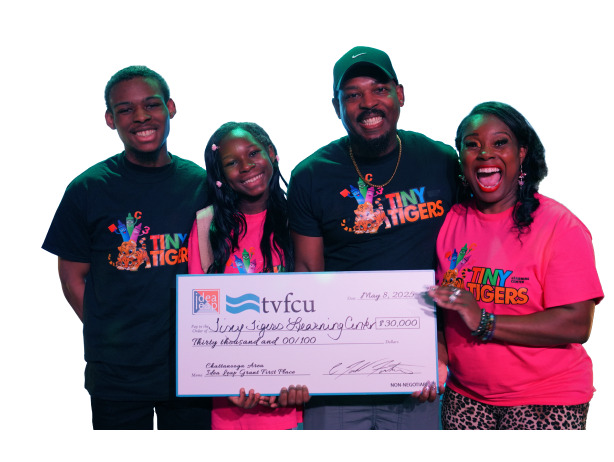

Idea Leap Grant

Fueling Ambition With Grant Funding

Launched in 2018, the Idea Leap Grant reinvests proceeds from our loan program back into the community, offering substantial grants to small businesses ready to take the next step.

- $225,000 total grants distributed across three regions: Chattanooga, Ocoee, and Northwest Georgia

- Grand Prize (1): $30,000

- First Prize (1): $15,000

- Runners-Up (3): $10,000 each

- Final pitch competitions during National Small Business Week

Idea Leap Partners

Our Esteemed Collaborators

Access to the Idea Leap program is only available through a referral. With referrals and assistance from collaborators, the vast majority of Idea Leap Loan recipients have started and expanded successful local businesses.

- CO.LAB — The Company Lab

- LAUNCHChattanooga

- SCORE

- Tennessee Small Business Development Center - Chattanooga

- Tennessee Small Business Development Center - Cleveland

- University of Georgia Small Business Development Center - Rome

- Urban League of Greater Chattanooga - NextLevel

- UTC - Urban Vision Initiative

- UTC - Veteran Entrepreneurship Program

Frequently Asked Questions

The Idea Leap program supports early-stage and startup businesses by providing financial resources through grants and loans to help them grow and innovate.

The Idea Leap Grant application is available once a year during the competition period. The Idea Leap Loan application is available all year. Loan applicants must be referred by one of our approved partner organizations. For more information, contact us at Idea.Leap@TVFCU.com.

The Idea Leap Program offers both grants and loans. Grants from $10,000 to $30,000 are awarded to winning startups that participate in our annual pitch competition. Loans are offered year-round in amounts ranging from $2,500 to $75,000 with flexible terms.

Business Banking Solutions

MERCHANT SOLUTIONS

Simplify Your

Day-to-Day Operations

Streamline your business operations with BancCard’s powerful payment solutions.

Learn MoreBUSINESS SHARE ACCOUNTS

Build Savings for Your Business Future

Secure funds with reliable returns and easy management.

Learn MoreBUSINESS CHECKING

A Solid Foundation for Growth

It all starts with checking. Explore our tailored account options.

Learn More