Who We Are

From our humble beginnings to regular award recognition, TVFCU has continued to proudly serve our communities every year since 1936.

Key Highlights From Our History

People Helping People

Volunteer Leadership Legacy

Steadfast Expansion

Member‑Focused

People Helping People

Volunteer Leadership Legacy

Steadfast Expansion

Member‑Focused

An Overview of TVFCU

By the Valley, For the Valley

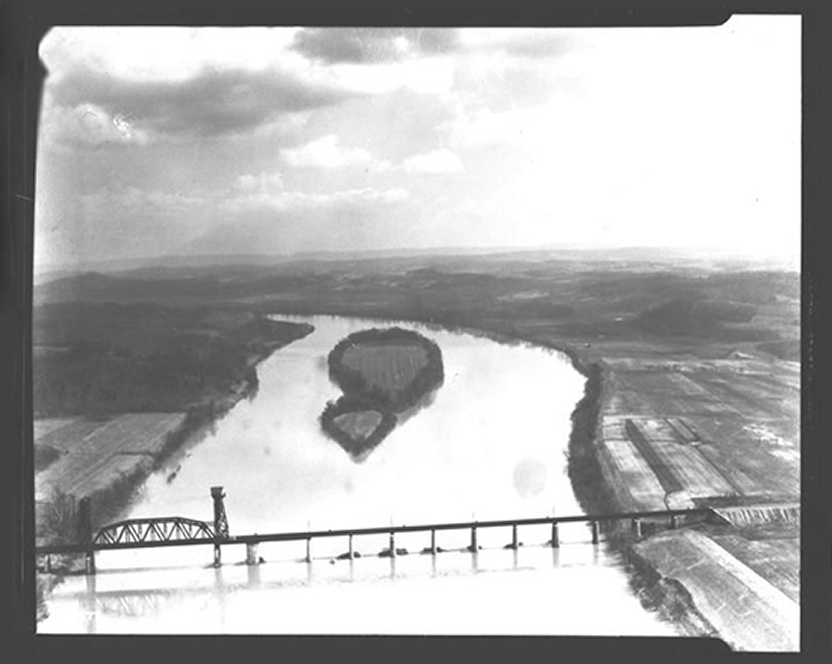

Today, TVFCU serves more than 174,000 members across Tennessee and Georgia. But our history begins in 1936, when 57 Chattanooga TVA employees pooled their money to create a member-owned financial cooperative.

See Our History

The History of TVFCU

Founded in the Spirit of Cooperation

In 1934, President Franklin Delano Roosevelt signed the Federal Credit Union Act into law, authorizing the formation of federally chartered credit unions across all states. The purpose of this federal legislation was to make credit more accessible and to promote thrift through a national system of nonprofit, cooperative credit unions. Tennessee Valley Federal Credit Union (TVFCU) was founded in 1936 as the Chattanooga TVA Employees Federal Credit Union — a not-for-profit financial cooperative built on the principle of “people helping people.” Initially, our field of membership included salaried TVA employees and their immediate family members working in Chattanooga, TN. On June 5, 1936, 57 TVA employees pooled their combined resources of $500 to officially charter the credit union under the Farm Credit Administration. Their mission was to “promote thrift through a cooperative effort and enable members to borrow money for providential and beneficial uses.” After the passage of the Federal Credit Union Act, the Bureau of Federal Credit Unions was initially housed within the Farm Credit Administration. Over the years, regulatory responsibility shifted to the Federal Deposit Insurance Corporation (FDIC), then the Federal Security Agency, followed by the Department of Health, Education, and Welfare. In 1970, the Bureau became an independent federal agency with the formation of the National Credit Union Administration (NCUA), which assumed the role of chartering and supervising federal credit unions. That same year, the National Credit Union Share Insurance Fund (NCUSIF) was established — a deposit insurance fund capitalized solely by credit unions, without the use of taxpayer dollars.

Finding a Home for Our Growing Family

In its early days, the credit union operated entirely through the efforts of elected volunteers. Deposits were taken over a desk and stored in a small lockbox in a bottom drawer — a far cry from today’s security measures. Despite modern advancements, our tradition of volunteer leadership continues through our Board of Directors and Supervisory Committee. In 1938, the Board hired its first employee, Nan Corbett. She was joined by Martha Claxton in 1940 and Dorothy Wilson in 1943. In 1954, R.O. Swisher became TVFCU’s first full-time office manager. That same year, the credit union established its first official office in the Pound Building, later relocating to the James Building. Over the decades, the credit union moved several times: to the Old Post Office Building and the Edney Building (1953), the lobby of the Patten Hotel (1966), and then to a larger facility at 709 Chestnut Street (1971). In 1978, we built our own headquarters at 715 Market Street. In 2015, the purchase of 535 Chestnut Street enabled the relocation and remodeling of our administrative offices, completed in 2017.

Sharing the Wealth With Family, Friends, and Neighbors

For many years, membership was limited to salaried TVA employees and their immediate family members. Eventually, eligibility expanded to include TVA trades and hourly labor employees, as well as household members of existing members. In 1983, the credit union broadened its reach by accepting Select Employee Groups (SEGs) beyond TVA. To reflect this growth, we changed our name in 1994 to Tennessee Valley Federal Credit Union. By that time, our membership included over 1,200 SEGs across Chattanooga and North Georgia.

In 2004, TVFCU received a community charter to serve the Southeast Tennessee Economic Development District, covering 13 counties: Tennessee – Hamilton, Bradley, Polk, McMinn, Rhea, Bledsoe, Sequatchie, Meigs, Grundy, and Marion, and Georgia – Walker, Catoosa, and Dade. In 2022, our service area expanded further with the addition of four North Georgia counties: Chattooga, Gordon, Murray, and Whitfield. Today, Tennessee Valley Federal Credit Union proudly serves more than 171,000 members across 29 branch locations. We offer a wide range of cost-saving financial services through multiple delivery channels — all designed to meet the diverse and evolving needs of our growing membership.

TVFCU Growth Over the Years

We’ve come a long way since 1936. Check out the snapshot below to see how much we’ve grown together.

| Year | Assets | Deposits | Loans |

|---|---|---|---|

| 1936 | $5,295 | $5,884 | $5,087 |

| 1949 | $174,410 | $159,000 | $135,000 |

| 1959 | $2,400,000 | $2,100,000 | $1,400,000 |

| 1969 | $10,000,000 | $7,000,000 | $6,200,000 |

| 1989 | $163,000,000 | $155,000,000 | $127,000,000 |

| 2013 | $989,062,331 | $865,965,186 | $521,940,364 |

| 2018 | $1,445,783,155 | $1,240,966,983 | $1,123,079,343 |

| 2022 | $2,470,366,635 | $2,168,797,365 | $1,751,124,524 |

| 2023 | $2,619,891,842 | $2,173,585,926 | $1,941,898,510 |

| 2024 | $2,860,970,576 | $2,425,501,001 | $2,019,960,314 |

| 2025 | $3,106,873,970 | $2,624,736,709 | $2,238,739,125 |

| Assets | $5,295 |

|---|---|

| Deposits | $5,884 |

| Loans | $5,087 |

| Assets | $174,410 |

|---|---|

| Deposits | $159,000 |

| Loans | $135,000 |

| Assets | $2,400,000 |

|---|---|

| Deposits | $2,100,000 |

| Loans | $1,400,000 |

| Assets | $10,000,000 |

|---|---|

| Deposits | $7,000,000 |

| Loans | $6,200,000 |

| Assets | $163,000,000 |

|---|---|

| Deposits | $155,000,000 |

| Loans | $127,000,000 |

| Assets | $989,062,331 |

|---|---|

| Deposits | $865,965,186 |

| Loans | $521,940,364 |

| Assets | $1,445,783,155 |

|---|---|

| Deposits | $1,240,966,983 |

| Loans | $1,123,079,343 |

| Assets | $2,470,366,635 |

|---|---|

| Deposits | $2,168,797,365 |

| Loans | $1,751,124,524 |

| Assets | $2,619,891,842 |

|---|---|

| Deposits | $2,173,585,926 |

| Loans | $1,941,898,510 |

| Assets | $2,860,970,576 |

|---|---|

| Deposits | $2,425,501,001 |

| Loans | $2,019,960,314 |

| Assets | $3,106,873,970 |

|---|---|

| Deposits | $2,624,736,709 |

| Loans | $2,238,739,125 |

Timeline of Events

2025

- Opens ninth In-Store Branch with Lee Highway Food City

- Opens North Georgia Headquarters and Dalton Branch in Dalton, GA

- Opens tenth In-Store Branch with Trenton Food City

- Renovates Kimball Branch

2024

- Opens Branch inside of Volkswagen, Chattanooga

- Opens sixth In-Store Branch with Chatsworth Food City

- Breaks ground in Dalton, GA

- Renovates Fort Oglethorpe Branch

- Opens seventh In-Store Branch with West Cleveland Food City

- Opens eighth In-Store Branch with Ocoee Food City

2021-2022

- Closes 715 Market Downtown Chattanooga Branch; Opens Market City Center walk-up Branch Downtown

- Unveils first-ever 3-D printed Southside Branch Building Facade

- Expands Community Charter into Chattooga, Gordon, Murray, and Whitfield counties in GA

- Opens fifth In-Store Branch with East Ridge Food City

- Branch inside Roper Corporation in Lafayette, GA opens

2019-2020

- Breaks ground for new Dayton Branch location

- Opens fourth In-Store Branch with Opening of Etowah Food City

- Builds a new state-of-the-art, free-standing branch in Dayton, TN, replacing the 1986 building and location

2017-2018

- Opens two locations inside area Food City stores, Red Bank and East Hamilton

- Renovates TVA Chattanooga Office Complex Branch

- Opens third branch inside Highway 41 Food City store location in Catoosa County

- Launches first Idea Leap Grant initiative, providing five grants totaling $50,000

2011-2015

- Opens Hwy. 58 Branch with dialogue concept

- Opens new Athens Branch with dialogue concept

- Purchases 535 Chestnut Street building to remodel for new administrative office

- Becomes the first credit union in the area to deploy interactive teller technology with the opening of the Ringgold Branch

- Begins extended hours of operation in the drive-thru with 7 a.m. to 7 p.m., Monday through Saturday availability through ITMs

2007–2008

- Opens new North Cleveland Branch with dialogue concept

- Opens new Eastgate Branch with dialogue concept

- Opens Soddy Daisy Branch with dialogue concept

- Opens Ooltewah Branch with dialogue concept

2001–2006

- Opens Fort Oglethorpe Branch

- Opens North Cleveland Branch

- Remodels Downtown Branch to dialogue concept

- Opens new Hamilton Place Branch with dialogue concept

- Opens new Hixson Branch with dialogue concept

- Opens Kimball Branch with dialogue concept

- Opens new South Cleveland Branch with dialogue concept

1991–1997

- Opens Cleveland Branch with merger of Bradley County

- Opens Athens Branch with merger of McMinn County Employees Credit Union

- Opens Hamilton Place Branch

- Moves Northgate Branch to Northpoint Blvd.

- Moves South Cleveland Branch to Keith Street

1986–1989

- Opens Dayton Branch with merger of Rhea Community Credit Union

- Opens Calhoun, GA, Branch (Branch closes in 1994)

- Moves administrative office back to 715 Market Street

- Opens Watts Bar Branch with merger of TVA Watts Bar Credit Union (Branch closes in 1999)

1983–1985

- Sells 715 Market Street building, credit union maintains first floor branch

- Opens Eastgate Branch and administrative office moves to Eastgate

- Opens Sequoyah Branch (Branch closes in 2008)

- Opens TVA Chattanooga Office Complex with two locations in Missionary Ridge Place and Signal Place Buildings (Signal Place Branch closes in 1995)

1971–1979

- Moves administrative office to 709 Chestnut Street

- Moves administrative office to 715 Market Street

- Opens Iuka, Miss., Branch (Branch closes in 1982)

- Opens Northgate Branch, which is shared with Combustion Federal Credit Union

1938–1966

- Establishes first official office in the Pound Building

- Moves administrative office to the James Building

- Moves administrative office to the Old Post Office Building

- Moves administrative office to the Edney Building

- Moves administrative office to Hotel Patten

Awards & Recognition

Don’t Just Take Our Word For It

We’re grateful for the trust you've placed in us for nearly nine decades, and even more honored to be named a favorite financial partner by so many. From local recognition to the pages of Forbes, we take immense pride in serving our community.

See Awards

Our Award Highlights

One of Tennessee’s Best Place for Working Parents; 2023, 2024, 2025, 2026

America’s Best Regional Banks & Credit Unions 2026 – Awarded Three Consecutive Years

Newsweek’s America’s Best Regional Banks and Credit Unions 2026 recognizes the best regional banks and credit unions in the

United States. The ranking is based on a comprehensive research study that incorporates in-depth desk research, a

large-scale nationwide survey and millions of online reviews to identify the 500 best regional banks and 500 best

credit unions in the country.

Awarded Best in State and the highest ranking credit union in the Country, 2021

Best in State, 2023, 2024, 2025

In fall 2021, the Tennessee Credit Union League recognized Tennessee Valley Federal Credit Union (TVFCU) for our commitment to social responsibility and our demonstration of the credit union mission of “people helping people.” The awards committee selected TVFCU from applicants from across Tennessee as part of Credit Union National Association’s (CUNA) Award Program.

CUNA created the Dora Maxwell Social Responsibility Award to encourage and honor credit union and chapter involvement in community projects and activities. Maxwell was a community activist who committed her life to credit union development, to her community and to serving the underserved.

TVFCU won the Dora Maxwell Social Responsibility Award for our efforts in spring 2020 to provide 800 complimentary Yoshino Flowering Cherry and Kwansan Flowering Cherry trees to those impacted by the rash of Easter Sunday tornadoes in the Chattanooga, Tenn., area. The trees were between 7 and 8 feet tall.

The Louise Herring Philosophy in Action Award is named for one of the original signers of the 1934 constitution who created CUNA and recognizes credit unions that do an extraordinary job incorporating credit union philosophy into daily operations. Herring started numerous credit unions and believed strongly in applying credit union philosophy as an operating principle.

TVFCU won the Louise Herring Philosophy in Action Award for our commitment to helping small businesses. In April 2020, TVFCU awarded the allocated 2020 Idea Leap Grant funds to existing Idea Leap members. The funds were distributed to 80 small businesses with Idea Leap loans to help alleviate some of the financial burden brought on by the COVID-19 pandemic. Then fall 2020, TVFCU created a smaller, virtual Idea Leap Grant Pitch Competition and presented grants to three small businesses.

By TVFCU winning these two awards on the state level, the award applications will advance to CUNA’s national level.

- Voted Best Credit Union Since 2008

- Voted Best Mortgage Lender (2012, 2013, 2014, 2016, 2020-2024)

- Voted Finalist for Best Bank, 2016

- Voted Finalist for Best Places to Work, 2019 & Winner in 2020, 2023

- Voted Best Company for Remote Work (2024)

- Voted Best Employer, Finance (2024)

- Voted Finalist for Best Customer Service (2024)

- TVIA voted as Finalist for Best Investment Firm (2024)

- Voted Best Credit Union Since 2010

- Voted Best Bank (2016)

- Voted Best Mortgage Lender (2016, 2018, 2019, 2020, 2022, 2023)

- Voted as Finalist for Best Mortgage Lender (2024)

- Voted Best Employer, Finance (2022, 2023, 2024)

- Voted Best Investment Firm – TVIA (2024)

- Voted as Finalist for Best Customer Service (2015)

- Voted as Finalist for Best Overall Place to Work (2024)

- Voted as Finalist for Employer, Best Company for Remote Work (2024)

Cleveland Daily Banner | Reader’s Choice

Voted Best Credit Union, 2016, 2022

Chattanooga Mortgage Bankers Association

Mortgage originator Jessica Parrish named 2022 Chattanooga Mortgage Banker of the Year

Daily Post Athenian | Best of the Best

Voted Best Credit Union Since 2016

Marion County Newspaper | Best of the Sequatchie Valley

Voted Best Credit Union Since 2015

The Herald-News | Best of the Best

Voted Best Credit Union, 2015

Seal of Satisfaction

Voted Best Credit Union Since 2007

Let’s Build Your Financial Future Together

Whether you’re ready to join or just have questions, we’re here to help you take the next step in your financial journey.

Contact Us